Who challenges ideas about what industry really is?

For over 200 years, through the four industrial revolutions, Fives has been reinventing itself to offer innovative industrial solutions which mark it out as a market leader.

The Group’s long-term growth and resilience is rooted in the diversity of its activity portfolio and geographic locations, and its decentralized and agile corporate model, bringing it closer to its markets and clients.

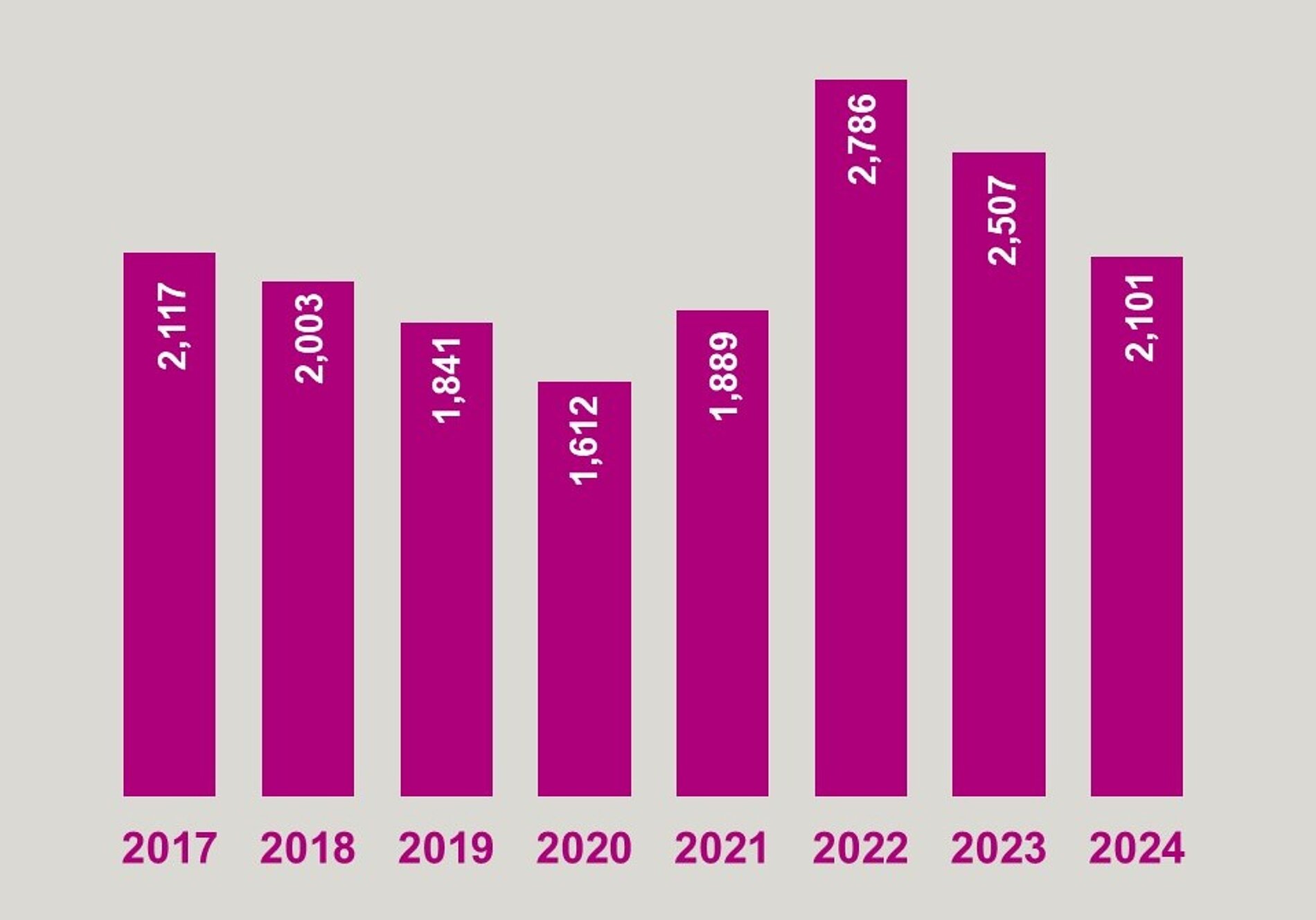

€2101 M

Order intake

€2269 M

Backlog

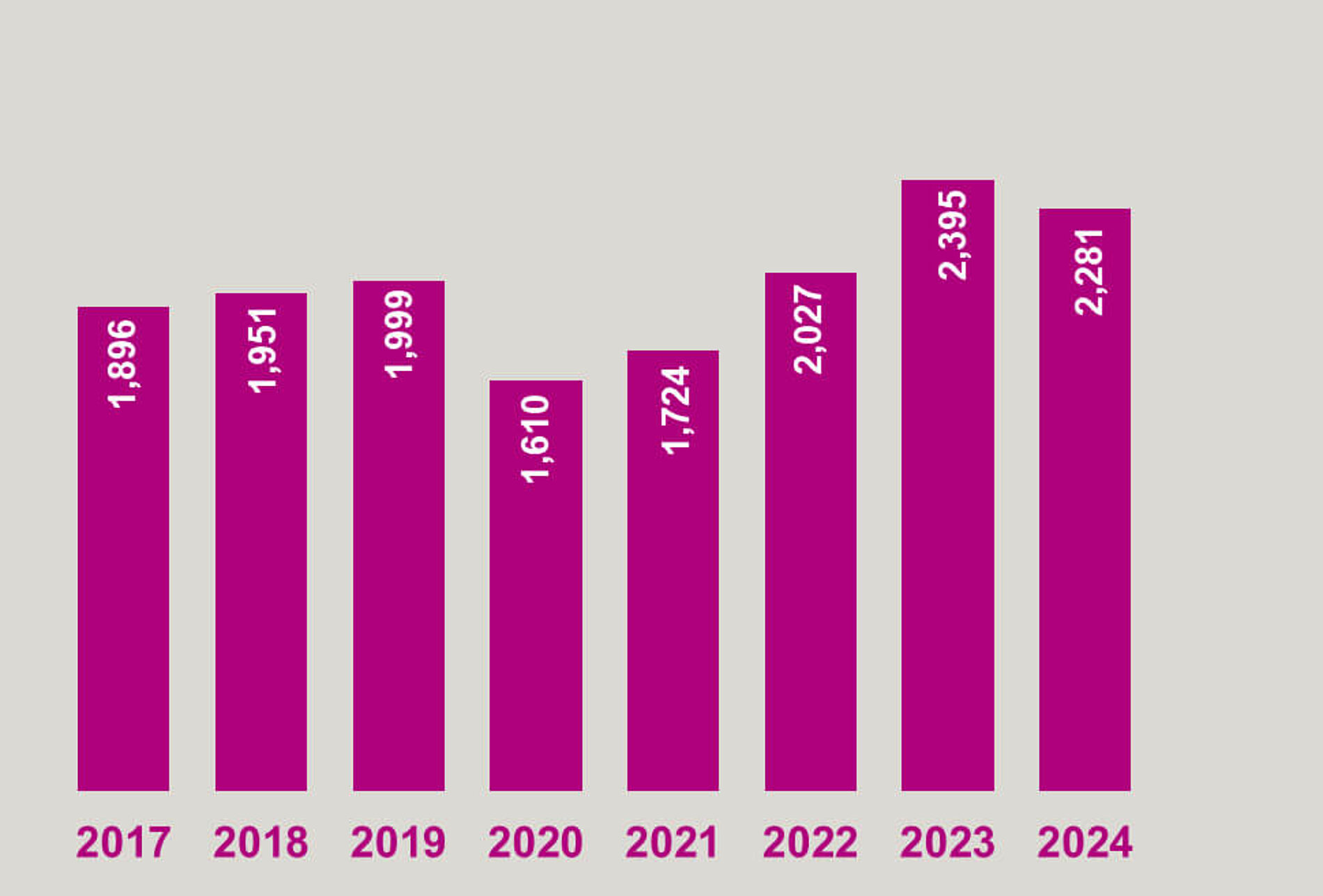

€2281 M

Sales

For sustainable performance

Fives’ ambition is to make itself future-proof and achieve long-term growth and profitability, benefiting all its stakeholders.

ORDER INTAKE (M€)

SALES (M€)

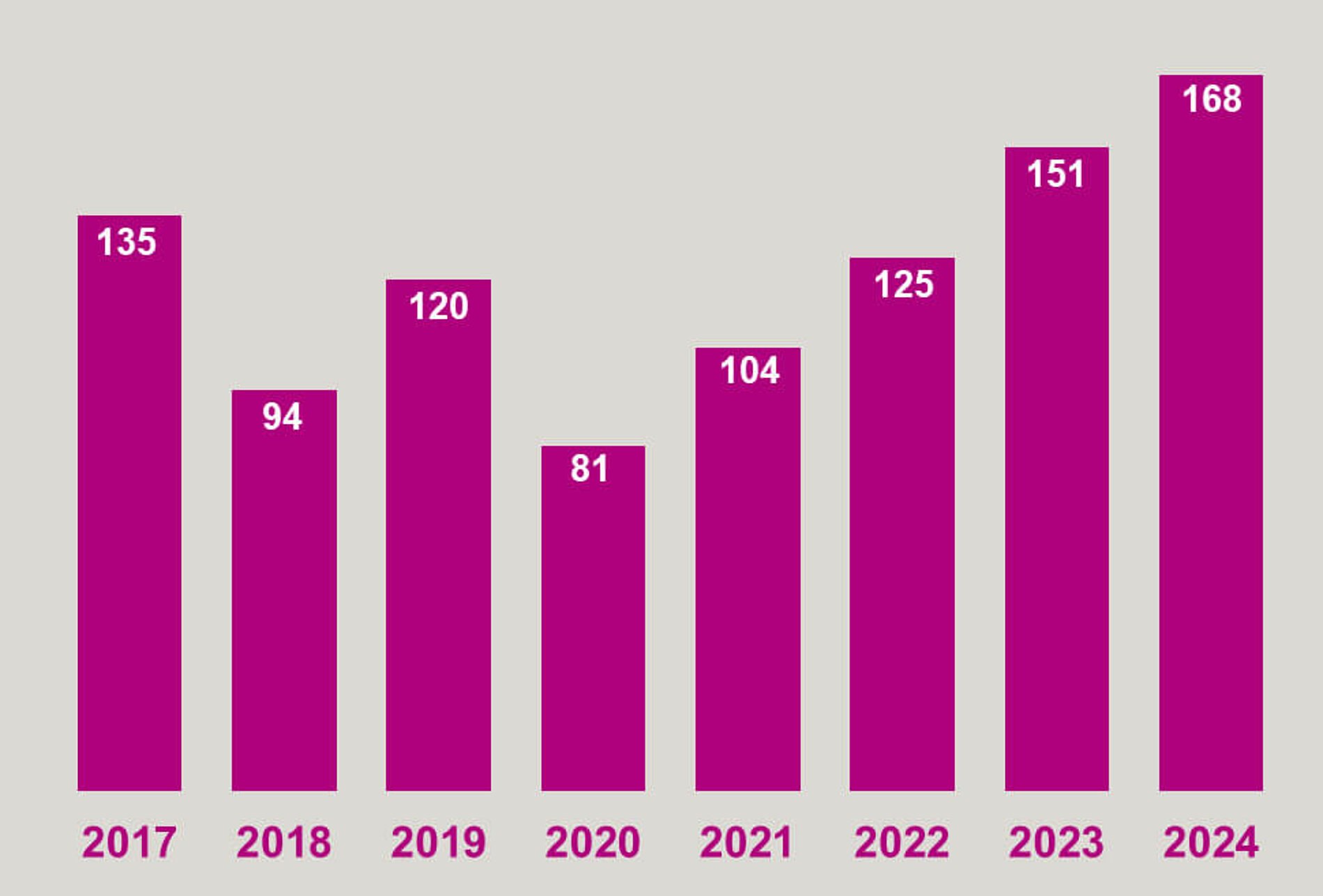

EBITDA (M€)

Great diversity, a source of agility

The markets diversity in the Fives Group activity portfolio is organized around three main activities (High Precision Machines, Process Technologies and Smart Automation Solutions) alongside other company-wide activities to develop a complementary software offer for the Group, and high added value digital services as well as specialized expertises.

This diversity enables Fives to be less affected by market cycles. It is what makes the Group resilient. This good balance relies on both:

- The variety of end markets served by the Group (from logistics to aerospace, through energy, steel and cement),

- And the different technologies it is developing, thanks to significant investment in R&D.

ORDER INTAKE, BY ACTIVITY

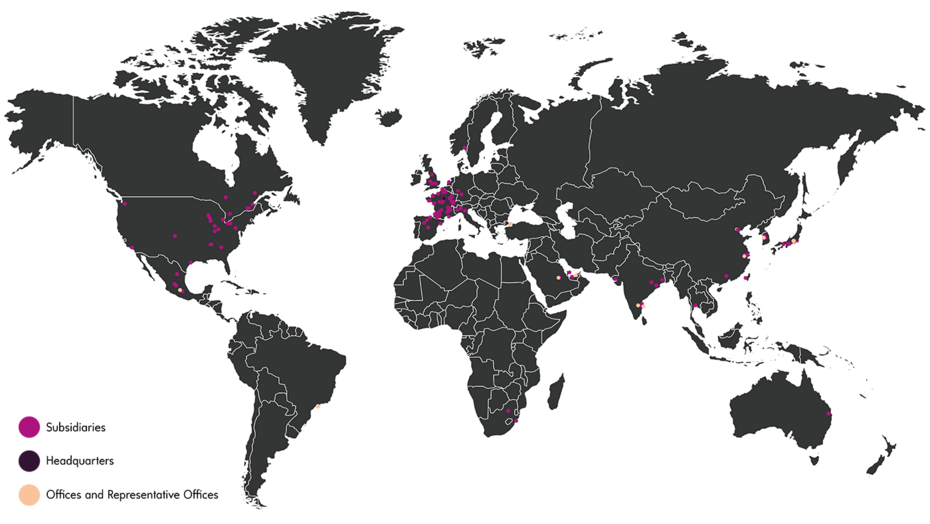

BOTH A LOCAL AND A WORLDWIDE GROUP

Fives operates mainly in three major economic zones - Europe, the Americas and Asia - and serves everywhere in the world.

With employees in 25 countries, Fives is able to reach most of its end markets with a local presence, enhancing the sense of a close relationship with its clients.

Order intake by geographic area:

Americas: 40%

Europe: 30%

Africa Middle-East: 12%

Asia & Oceania: 18%

A STRATEGY BASED ON CUTTING-EDGE SOLUTIONS,

Both global and tailored-made, for a customer support throughout their value chain.

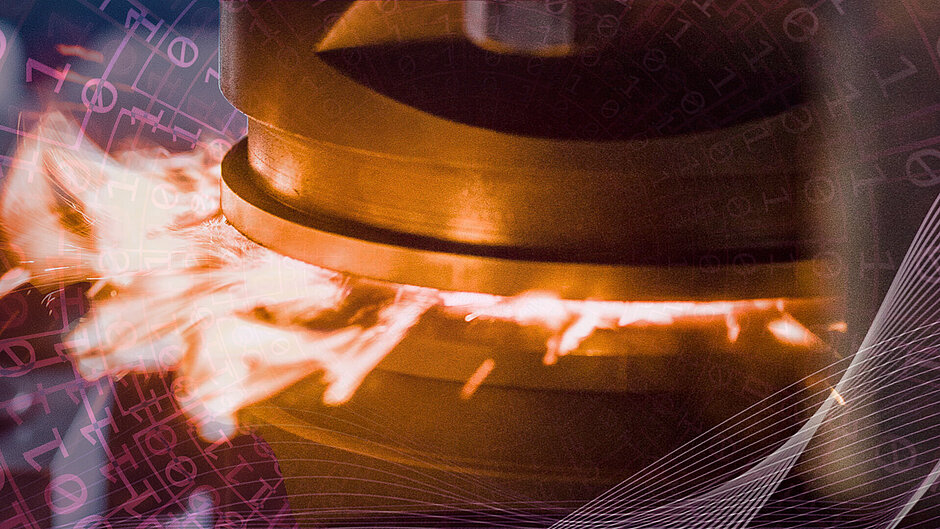

In its 38 R&D and test centers, Fives is constantly preempting the needs of industrial manufacturers in terms of performance, quality, and environmental impact. The Group offers manufacturers new solutions which integrate digital monitoring, computer simulations, AI, machine learning, preventive maintenance, new materials, additive manufacturing, and more.

But innovation at Fives isn’t simply measured in terms of what new equipment the company brings to market: innovation relies on teams’ ability to develop new uses for current tools, or to upgrade them, beyond the beaten track.

Fives’ R&D strategy is rooted in a particularly agile mindset, and three areas of development:

- Open innovation, to be among the very best, and reap the benefits of their ecosystem and shared R&D programs when the Group chooses not to invest in a technology internally;

- A global designer-integrator offer, because Fives is one of the rare industrial engineering Group with these two layers of expertise: both designing the machines and the industrial process it emerges from. This is how Fives is able to understand factories with an overall vision of the production system, which integrates all performance levels for equipment and their processes, from design to manufacturing and development stages.

- The scalable client strategy: Fives’ approach to its clients is agile and collaborative, to offer them solutions suited to the needs of their market, while reducing delivery deadlines and adapting to their constraints.